A deep dive into Nvidia

Possibly the most-hyped company in the world today. Let's see what's underneath the hood.

Introduction

Welcome! This is the first article in my newsletter where I do deep dives into a company’s product, tech, and financial position.

To start, a little bit about myself. Professionally I am a software engineer who loves building products and exploring new tech. As an investor, I have a long-term mindset where I buy wonderful businesses at a fair price. I believe in understanding a business thoroughly before investing in it. But most people face obstacles when trying to learn about companies:

They don’t have the time to spend weeks scouring annual reports and financial statements.

They are overwhelmed by low-quality, poorly-researched information.

The information they find is too technical to digest or use, unless they have a PhD or years of software engineering.

Here’s where this newsletter comes in. I spend about 3-4 weeks researching a single company. I then take this deep research and boil it down to simple concepts that everyone can understand. Hopefully, you’ll walk away with a better grasp of each company, and feel more confident about your investment decisions. When we talk about technical concepts in the product or the finances, I’ll do my best to provide context and put it in terms of a common-sense explanation.

A few reminders here:

I’m not giving investment advice. I’m going to talk through how I interpret different pieces of information, but at the end of the day, you should make your own decisions to buy, hold or sell. This newsletter is meant to be one of many tools in your toolbox.

This newsletter isn’t about trading, or options, or making a quick buck. It’s all about long-term horizons, letting compound interest do its thing, and being very patient.

For almost everyone, the best advice is to buy an index fund that tracks the S&P500. That’s the easiest thing to do and will get you the best return-to-effort ratio. But if you like reading, and you want to use a reasonable portion of your portfolio to pick individual stocks, then this should be helpful to you.

Without further ado, let’s start with possibly the most hyped name in today’s stock market, Nvidia (NVDA), and see if we can wade through some of the misconceptions about this company. I have held a position in NVDA for the last 18 months. My initial investment was pretty small and, while I’ve been enjoying watching the run up of the stock price, I’ve been itching to buy more. The goal of today’s analysis is to find out whether it’s a good time to do so.

🗣

I completed most of the research for this article prior to July 16, since when Nvidia stock is down about 15%. The research and conclusion is largely unaffected by that movement. I plan to release an update for Nvidia after their 2024 Q2 earnings call on August 28.

Understanding the product

Most people understand that Nvidia is helping power today’s AI revolution, but don’t know the specifics of how. Let’s do a little background to put their products in context.

How do the latest AI models work?

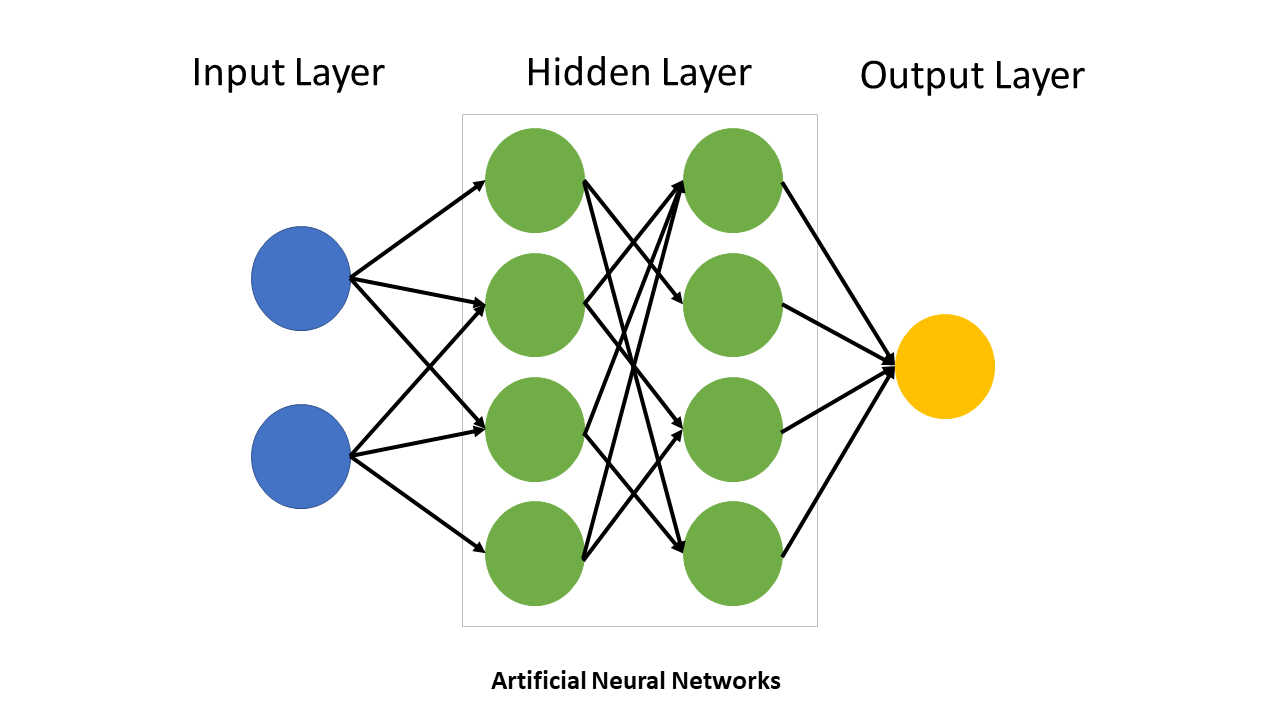

The craze surrounding seemingly-intelligent chatbots, such as ChatGPT, has driven a lot of the hype in the AI cycle. A later article will be dedicated to the mechanics of these chatbots, specifically the large language models that power them, but the key for today is the underlying architecture called a neural net. Neural nets are the most advanced and powerful architecture that are currently in wide use for machine learning. The design of neural nets seeks to emulate that of a human brain - there are many, many nodes that communicate with each other to make complex decisions. Generally, the more nodes in the net (the bigger the brain), the more powerful it is. The race amongst engineers is to make the biggest “brain” possible, so the models can be the most effective and accurate in making decisions.

We can improve AI model performance if the models can handle more nodes and more parameters.

What is a GPU, and why are they needed?

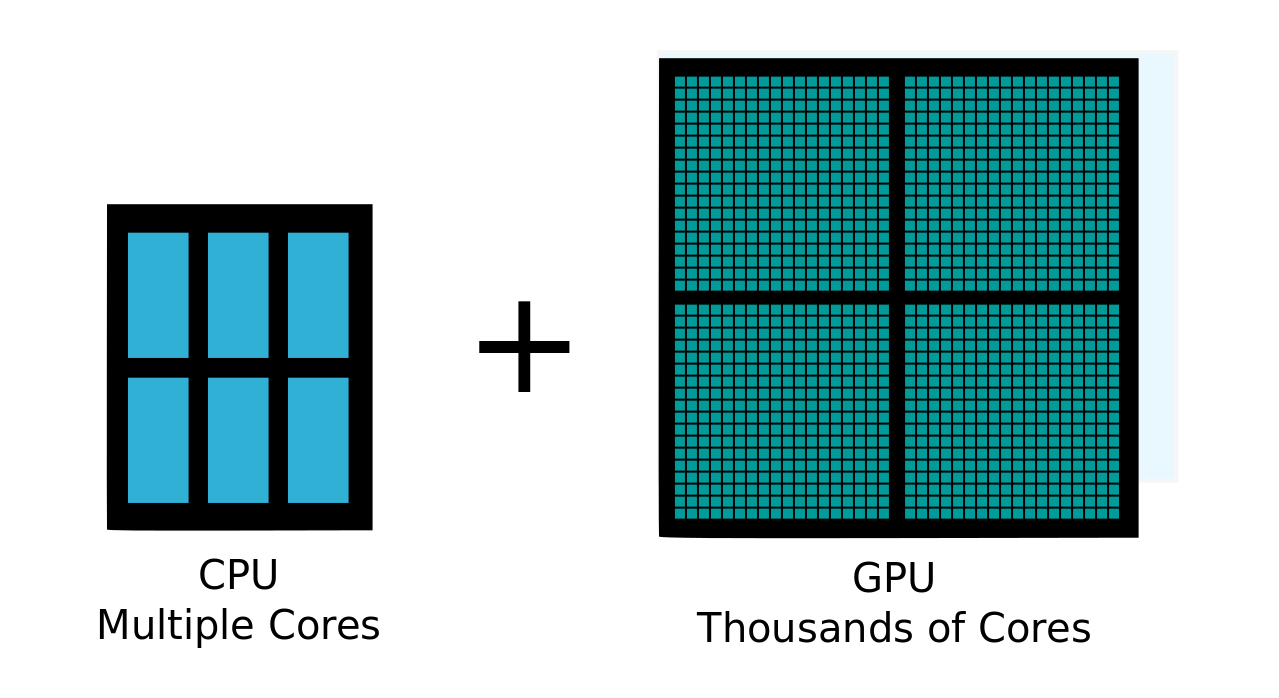

You should be familiar with a CPU, the traditional compute that powers software. A CPU is good at performing certain types of tasks, but the time and efficiency of these tasks is limited by how big the CPU is. Think about having to lift 1000 pounds. If I had one powerful bodybuilder, they could lift the 1000 pounds by themselves. That’s a CPU.

How is a GPU different? A GPU is a graphical processing unit with many many more cores than a CPU, which allows it to parallelize tasks. Instead of the one bodybuilder picking up all 1000 pounds, I could instead have 100 average people each pick up 10 pounds. I’m accomplishing the same outcome, but I’ve split up the work amongst many workers. That’s a GPU. (GPUs were originally built for what the name says - to process graphics. Consider a TV that has 2 million pixels. A GPU decides what color each pixel should show, and it has to be really fast since it’s making these decisions multiple times per second. The chip parallelizes the work by dividing the tasks up amongst each core of the GPU. No pixel cares or needs to know what another pixel is showing. This is considered highly parallelizable, compute intensive work - perfect for a GPU).

GPUs happen to be perfect for building AI models. Remember the nodes we talked about in the previous section? The work for each node can be delegated to a core within the GPU. Once again, this is highly parallelizable, compute intensive work. GPUs have unlocked huge advancements in the processing capabilities of AI models. Let’s tie this back to our understanding of AI models from the last section: the more powerful a GPU is, the more nodes can be in the neural net, and the bigger the “brain” is. Better GPUs will enable better AI models.

What does Nvidia’s product do?

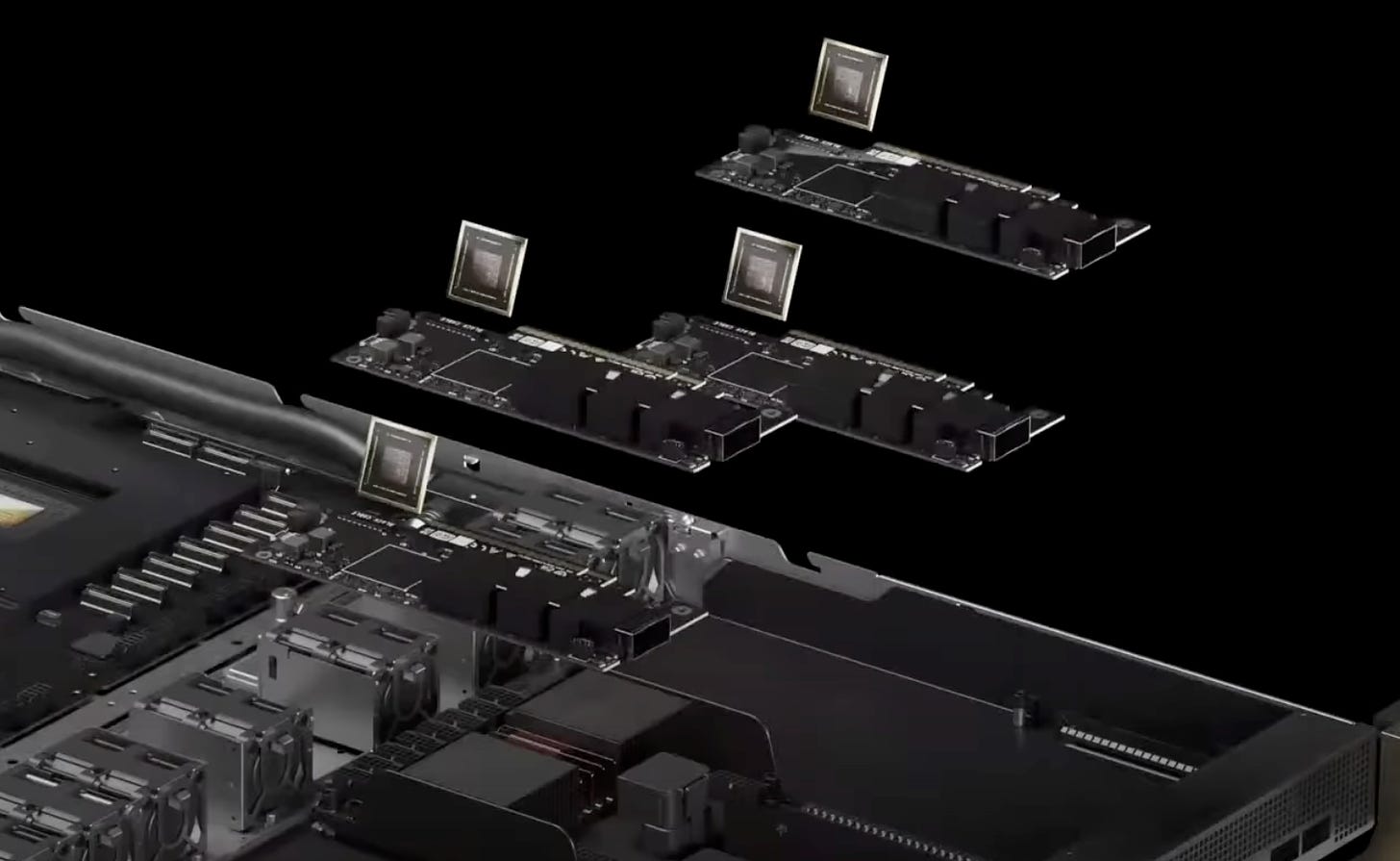

Nvidia designs GPU chips. (Note, they don’t actually build them. They rely on TSMC, a Taiwanese-based company to do so. We’ll talk a little bit about the supply chain later in this article, and a future article will deep dive into TSMC.) Their goal is to add as much compute power to a single chip as possible; they can then bundle these chips together in a larger architecture to provide “AI factories” to customers. Let’s look at how that plays out:

Start with the H100 GPU chip (the current-gen Hopper architecture, hence the ‘H’)

Combine an array of these chips with the NVLink platform, allowing the compute to be “stacked” or added together to form one giant GPU, called the DGX

Multiple DGX nodes are then subsequently stacked, using an ultra-low-latency networking interface called the Quantum-2 InfiniBand, to create an AI supercomputer

Hundreds of these AI supercomputers are operationalized, creating an AI factory

This is what people are talking about when they mention Nvidia’s AI factories. We’re talking about hundreds or thousands of GPUs that have been optimally combined to create the effect of one giant AI processing node. Nvidia has successfully built a scalable architecture for their already-best-in-class chips. That’s what allows customers to create super-powerful AI models, like ChatGPT and Gemini and Claude. Without this level of processing power available, we wouldn’t have seen the popularity explosion of AI chatbots. Nvidia is what’s enabling the innovation behind the scenes.

What makes Nvidia better than its competitors?

They were early to recognize trends. Nvidia has consistently been ahead of the curve when it comes to identifying consumer demand, first with gaming, then cryptocurrency, then AI. They’ve taken advantage of this foresight by getting a head start on building chips that are optimized for each use case. They delivered a flagship GPU to OpenAI (makers of ChatGPT) long before anyone was talking about either company. They’ve had such a long head start, that no competitor has been able to close the gap.

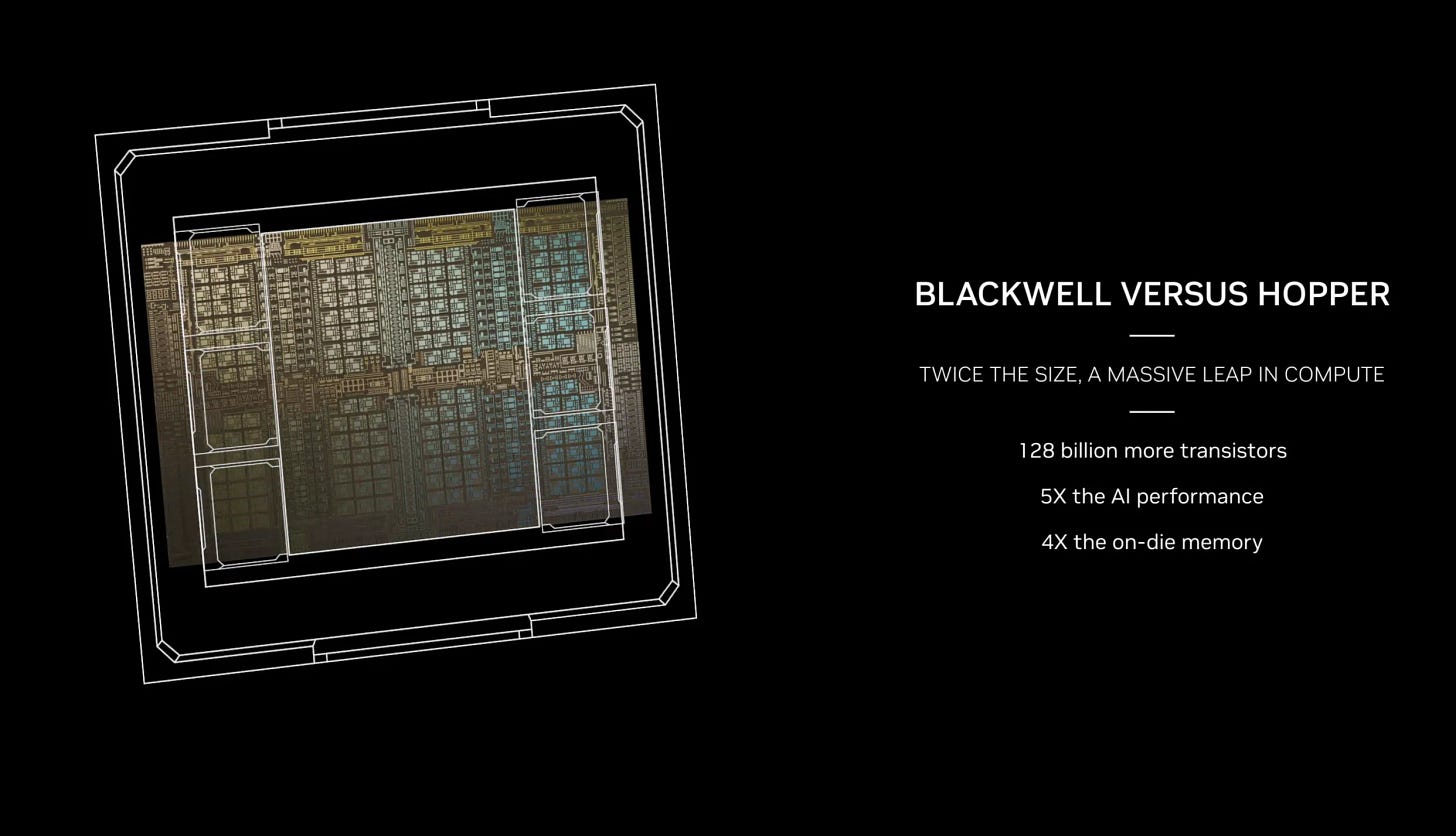

They’re at the forefront of Moore’s Law. That law (really more of a prediction) says that the number of transistors on a chip will double roughly every two years. (For simplicity’s sake, more transistors on a chip means a more powerful chip. That’s all we need to know for today’s purposes.) Nvidia has consistently had the GPU chip with the most transistors on it. Everyone else is trying to catch up, while they keep moving ahead.

They’re innovating the architecture of chips. They recently announced a next-gen architecture, called Blackwell, which is literally pushing the boundaries of physics. It’s estimated to be anywhere from 3-5x more powerful than the current-gen Hopper chips (which was already the industry leader by far). It’ll require specialized custom manufacturing processes to build. That architecture is a key part of their secret sauce - competitors simply haven’t figured out how to reach that level of compute and throughput. In the last 8 years, Nvidia’s GPU chips have seen a 1000x increase in AI compute power. That level of improvement is hard to fathom.

They’ve built a compelling ecosystem. On top of their hardware, Nvidia has the CUDA platform, which is meant to help developers build AI software. It simplifies (or in software engineering terms, “abstracts away”) the complexity of writing code that takes advantage of the GPU’s capabilities. This is then extended to a whole suite of libraries, APIs, and tools that make the developer experience easier. Think of it like this: instead of having to know how an internal combustion engine works, I can just push the accelerator pedal in a car and make it go. Sure, I could spend the time to build an IC engine on my own and not be dependent on a car manufacturer. But am I really going to do that? No, I’m going to buy a car and learn how to be a good driver just by using the pedals. Similarly, I can make the best AI product not by reinventing the underlying hardware, but instead by using what’s already been built for me. Nvidia has done such a good job of providing useful tools and platforms that it’ll be an uphill battle for competitors to displace them as the de-facto go-to option.

What are risks to their product dominance?

Geopolitical tensions could upset the supply chain. As mentioned earlier, Nvidia designs the chip, but they rely on a Taiwanese-based company (TSMC) to manufacture the chips. TSMC is the main global manufacturer of these chips, so any interruption to their operations could have devastating impacts on Nvidia’s ability to meet customer demand. Taiwan has long been a hotbed of contention between the US and China, even more so lately with the upcoming presidential election. If - and this is unlikely, but possible - the US and China escalate their jockeying over Taiwan, we could see the operational disruption that would severely impede Nvidia.

Newly-minted millionaires at Nvidia could cause brain drain. “Brain drain” is a term that refers to the loss of critical employees in sales, operations, engineering, etc - specifically employees that had a lot of institutional knowledge, and had a big hand in the success of the company. Success can cause brain drain: huge windfalls in bonuses or stock give people the cushion to leave, employees are hired by competitors, employees leave to start their own businesses. Overall, it’s a good problem to have, because it means the company is highly successful and has talented employees, but it can still be a short-term risk.

Major customers could change their mind about continuing to spend in the AI arms race. AI-powered products have demonstrated a noticeable absence of profitability during this early stage of investments (one of the reasons that hype has outpaced reality). Google, in their earnings call, justified their AI spend by saying that the risk of not investing was higher than the risk of overspending. What happens if the tech sector, as a whole, decides to scale back on AI expenditure because the bottom line doesn’t justify it anymore? Nvidia’s business could take a hit in the short term.

Nvidia has taken a huge head start and combined it with constant innovation, to grow their lead at the front of the pack. Even if all they did was design GPU chips, they’d still have a technologically dominant product. But their dominance extends further, to the highly compelling ecosystem that makes developers’ lives much easier. There are some inherent risks, but not significant enough (yet) to raise concerns about the product.

💡

The key takeaway from the product and tech analysis: Nvidia has a stranglehold on GPU chip design. They’re by far and away the best in the industry, and they keep innovating to stay at the front of the pack.

If I was making an investment decision solely based on product/tech, I would not hesitate to buy shares in this company.

Understanding the financials

Let’s look at some basic financial metrics for the company to understand if it’s “healthy”. We won’t get deep into financial jargon, but instead we’ll focus on common-sense numbers that paint a picture of the company’s books.

Are they making money?

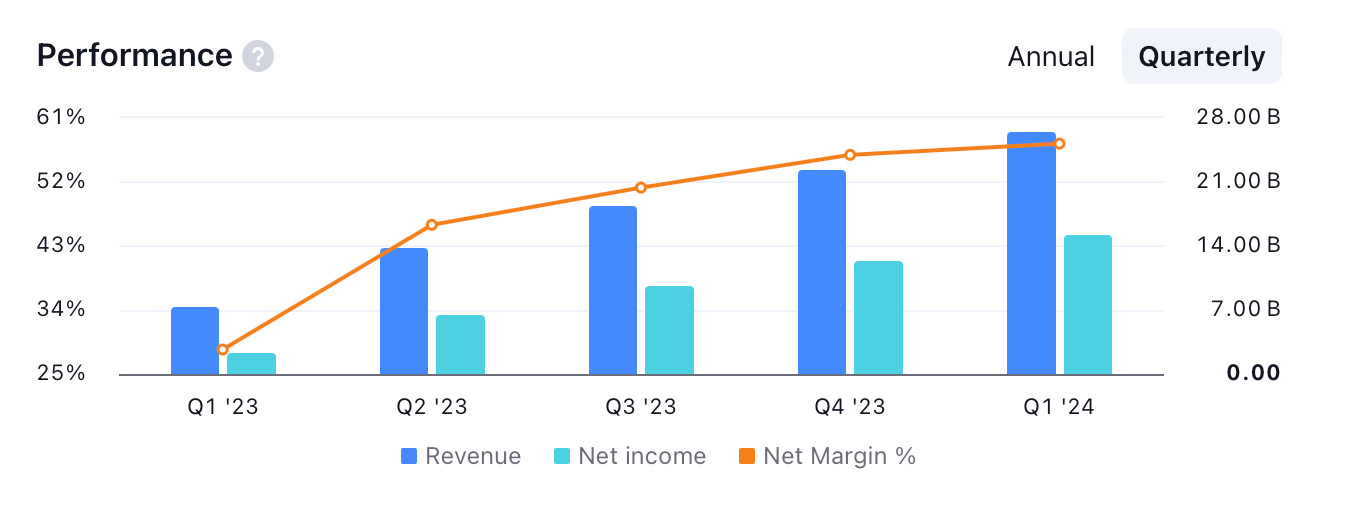

Revenue has been consistently growing each quarter, and is continuously hitting all time highs. The company has averaged 50% year-over-year growth (!!) in the last 4 years; zooming in, they have 30% quarter-over-quarter growth in the last year.

Net income is growing too. In 2023, revenue doubled, but net income grew by a factor of 6x. That means they’re keeping a larger chunk of their revenue with each passing quarter. Are their processes become more efficient? It seems like it.

Earnings per share (EPS) grew as well, especially in 2023 (6x growth). If we look at the trailing twelve months (TTM) instead of FY23, then EPS has been even higher, indicating continued growth.

Free cash flow - guess what? Consistent massive growth, with a huge jump in 2023, with the TTM being even higher. I’m a broken record here.

What more can I say? Nvidia is making a ton of money.

Are they making money efficiently?

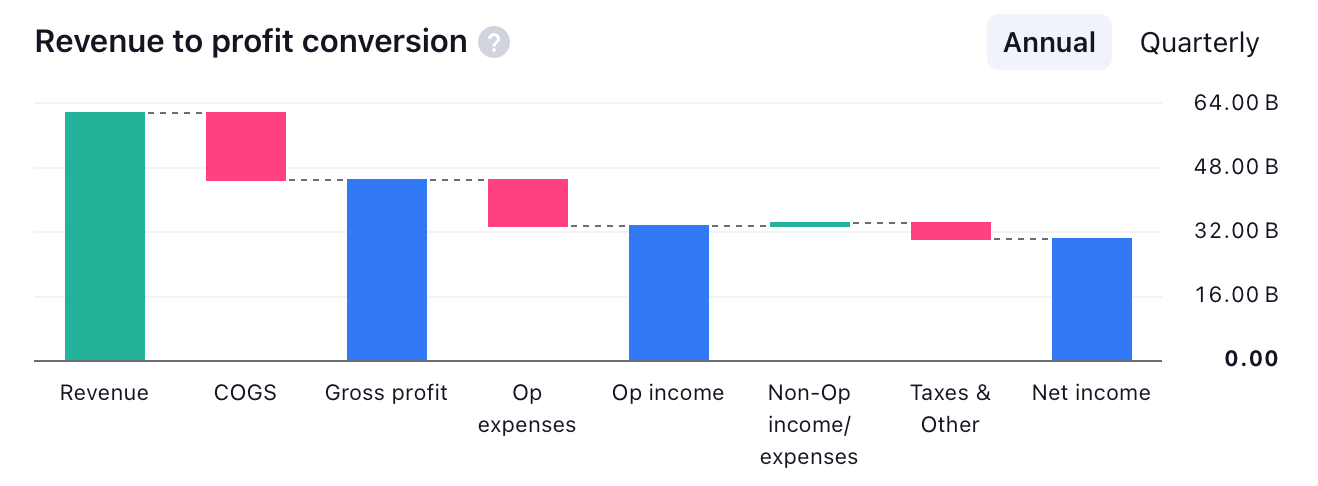

Let’s look at two margins here - gross (revenue minus cost of goods) and net (revenue minus cost of goods, operating expenses, taxes, etc). Both are shockingly high for a company that sells physical products.

Their gross margin has averaged in the mid-60%s for the last 5+ years. It’s actually increased in the last few quarters to the mid-70%s. The business is being run efficiently, and more importantly, it’s scaling really well.

Their net margin has performed well too, averaging mid-30%s for the last 5+ years and also increasing in the last few quarters to mid-50%s. Efficient and scalable.

Couple things worth noting about these margins:

Nvidia’s margins are more impressive than other chip design companies. AMD is nowhere close, while Broadcom has some healthy metrics (but not nearly as impressive as Nvidia).

2022 was a slight dip (albeit not significant) from their continued run of excellence. 2022 was when Nvidia released an updated chip architecture (Hopper), so it makes sense that there was a slight dip in efficiency as they had to deal with optimizing the production and deployment of new chips. With Blackwell coming out soon, I wouldn’t be surprised to see another slight dip in efficiency before returning to world-beating levels.

Nvidia is making a ton of money, and they’re doing it really well.

What are their liabilities?

Net debt is negative, meaning they have far more assets / cash than liabilities. That’s a very strong cash position for any company, let alone one that’s innovating so aggressively.

It’s trending in a positive direction too, with assets increasing by 75% versus liabilities increasing by only 25% over the last 4 quarters.

Short story short, there’s nothing to be worried about in terms of their debt.

Nvidia is innovating without increasing costs - their competitive advantage grows at the same time that they become more efficient. Hard to fathom.

💡

The financials of this company are unimpeachable. They’re growing revenue, improving margins, and reducing debt. Their margins and debt numbers are borderline unbelievable when you consider that they’re making hardware products, which typically have lower margins than your standard SaaS company.

They’re somehow doing this while still innovating. Their lead on the competition is growing without them needing to eat into their financial health. Truly incredible.

If I was making a decision purely based on the financial health of the company, I’d buy it in a heartbeat.

Understanding the valuation

Here’s where things become a little more interesting. We’re trying to figure out if the company share price is fair or not. Let’s start with a few valuation ratios to understand where Nvidia stands relative to its competition.

What do the metrics say?

Market capitalization of $2.78 trillion dollars, good for 3rd in the world (after briefly peaking at #1). This is much higher than competitors in its industry (4x Broadcom, 10x AMD). That’s a huge market cap for a company that was largely unknown 3 years ago, and doesn’t sell directly to consumers.

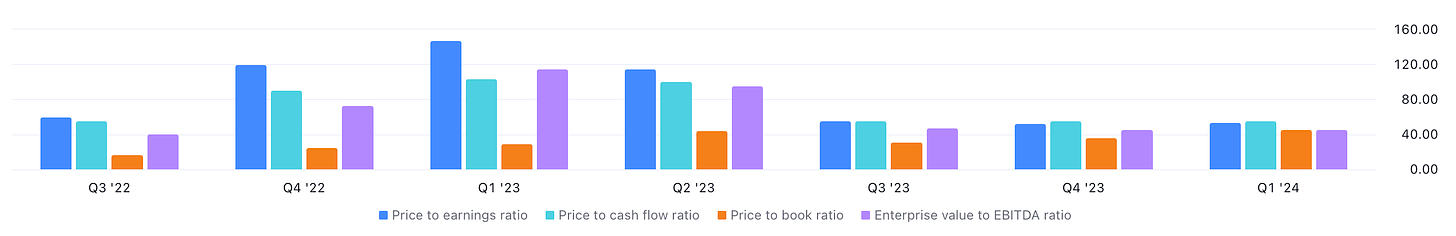

Price-to-earnings ratio of approximately 65. This ratio tells us how expensive a stock is relative to other investment options. (For reference, the S&P average is in the mid-20s. Broadcom is 65, AMD is 202.) The higher the ratio, the more of a premium you have to pay to benefit from the company’s earnings. Ideally you want to find companies that have a low PE. In this case, the PE is very high compared to the S&P, but not high compared to competitors in its industry. To make sense of this, we need to remember that the AI hype has driven the entire semiconductor industry to record highs. The entire sector is overvalued, meaning that Nvidia is only slightly less overvalued than the rest. Overall, a company with a PE this high carries inherent risks.

Quick counterpoint: in 2023 Q1, Nvidia’s PE was 145, an astronomically high number. Since that time, the stock price has tripled. The PE ratio should have increased, right? Nope - the PE is lower now than it was then. The earnings growth has outpaced the price growth so much that the PE actually came down - truly crazy! The takeaway here is that a high PE is a risk, but not always a dealbreaker.

There are other metrics we can look at, such as price-to-cash-flow ratio, price-to-book ratio, or enterprise-value-to-EBITDA ratio. But it would be redundant, they all tell the same story of a company with sky-high valuations, but whose ratios are actually decreasing because of how impressive the earnings are.

What might the company be worth in the future?

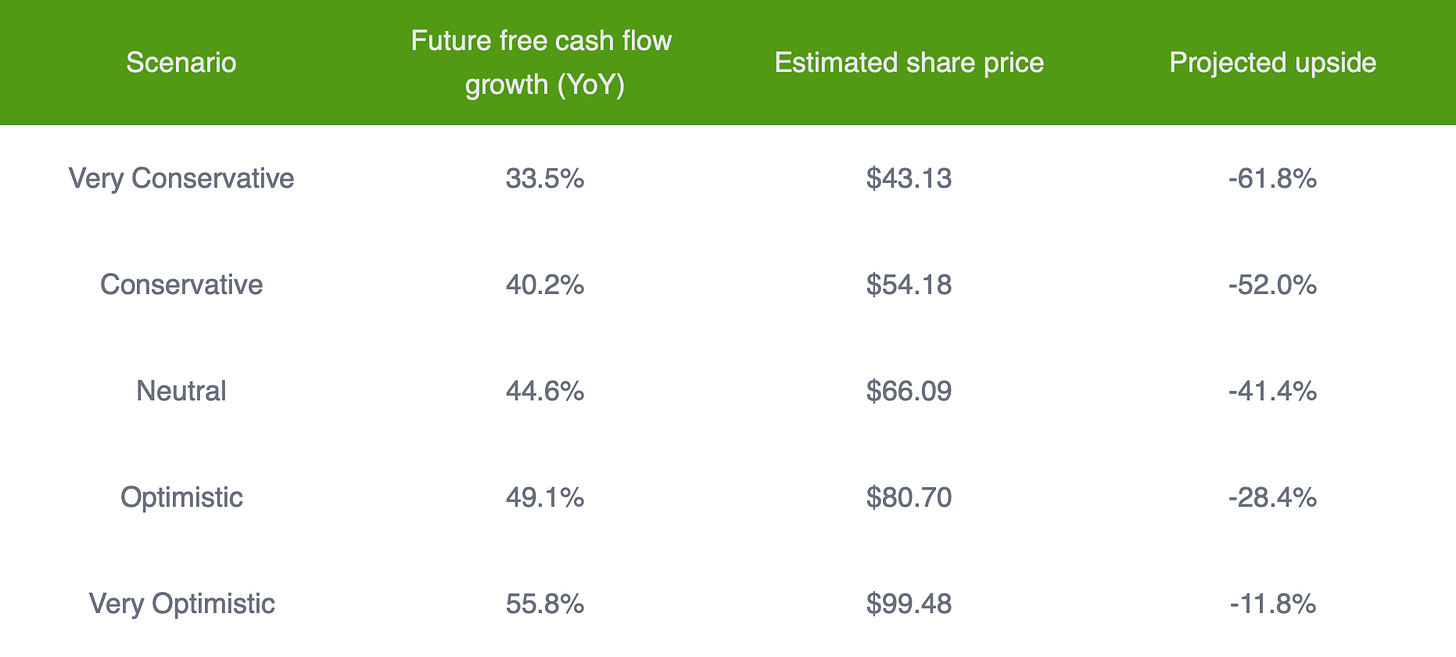

Without going into the nitty-gritty of how this analysis works, DCF estimates the value of a company by projecting its cash flows for the future. I don’t treat it as a definitive price target for a company’s shares, but instead I use it to get a range of possible outcomes. This helps me judge the likelihood of positive growth for the share price. (Note: I’m not laying out the full calculations I did, only the most basic numbers that give the average reader an anchor for each projection. There’s a lot more to it than the table below. Check out the footnote if you’re interested in some of the assumptions I made for the model.1)

Even in a very optimistic scenario, where free cash flow grows over 50% each year (keep in mind, this is higher than the insane-hot-streak/world-beating growth rate it’s had), the estimated share price would still be more than 10% lower than it’s current price. This isn’t encouraging. It indicates that so much of this potential future growth has already been baked into the price - in other words, people expect Nvidia to continue growing at crazy rates for the next half decade or more. That puts the share price in a precarious position - the slightest underperformance, and suddenly the price doesn’t seem worth it, and people panic.

What’s a company that had a similar journey?

Let’s compare Nvidia and its place in the AI boom to a similar company during the dot-com boom, Cisco.

Similarities:

Both were selling the proverbial “picks and shovels” of the gold rush. Cisco sold networking infrastructure (routers, switches, etc) that were in high demand as companies started to move online. Cisco was the unquestioned leader in the space (for a time), and anyone who was trying to ride the dotcom wave was dependent on Cisco products. All this sounds exactly like Nvidia today.

Both came out of nowhere to briefly become the most valuable company in the world.

There were huge hype cycles (dotcom, AI) during the times of their ascension where investor craze pushed these companies to be the poster children of their respective revolutions.

Why these similarities are a warning to Nvidia:

After Cisco’s insane run up in stock price, it proceeded to drop by 80% in less than a year. In the almost 25 years since, it has never reached those highs again. The company still exists, and is still a behemoth in the networking sector, but it never exceeded the peak of 2000.

If you had bought it at the top of the hype cycle (unfortunately as many are prone to do), you’d have averaged -2% over the last 25 years, culminating in a near 40% loss.

Created with TradingView

If you had bought Cisco a couple years later, you’d have 5x your investment over the course of 20-some years, giving you a modest 7.5% annualized return. Better than the -40%, but about the same as (if not less than) the S&P return over that same time period, which is a far less risky bet.

From the Cisco annual report in 2000 right before the crash: “In our opinion, the radical business transformations taking place around the world will accelerate, making the opportunities ahead of Cisco far greater than ever before. We believe that Cisco has the potential to be the most influential and generous company in history. We are in the fortunate position to be at the center of the Internet economy.” Famous last words.

Differences:

Nvidia’s financial position is much stronger than Cisco’s was at the time. Notably, Cisco had a much lower net margin, primarily due to high operating expenses. When sales declined following the dot-com bust, Cisco quickly turned in a net income loss, which is a borderline death sentence for a company that had so much optimism baked into its valuation.

Amongst technical folks, Cisco was known as a clunky behemoth that moved slowly and sold fine (but not amazing) products. When competitors arrived on the scene (see Juniper Networks) with an agile, cost-effective and functionally-comparative offering, Cisco quickly began to lose its competitive advantage. This stands in stark contrast to Nvidia today, whose products are superb and who continues to innovate at an industry-leading rate.

Top level management is very different - John Chambers of Cisco had a sales background, whereas Jensen Huang of Nvidia is an engineer who understands the technical differentiators of his product. Chambers took charge of Cisco only 5 years before the dotcom bust, while Huang has been the founder and CEO for over 30 years. Chambers is your standard executive-rising-through-the-ranks type, while Huang is a fighter who scrapped and clawed for the survival of his company from day one. I believe the background, skillset, and experiences of Huang lend a major advantage to Nvidia.

Conclusion

Nvidia is a wonderful business, making a wonderful product. It’s the unquestioned leader in the space, yet it continues to innovate and push the boundaries of what’s possible. It has a visionary and effective leader in Jensen Huang. It’s financials are healthy to the point of being almost unbelievable. In a vacuum, I’d love to own as much of this business as possible.

But there are risks. The current valuation, and thereby the current stock price, are so excessively pumped up because of AI hype that the slightest misstep in earnings could cause the company’s valuation to come tumbling down. There could be plenty of runway for the price to increase further, but betting on that will require incredible levels of optimism.

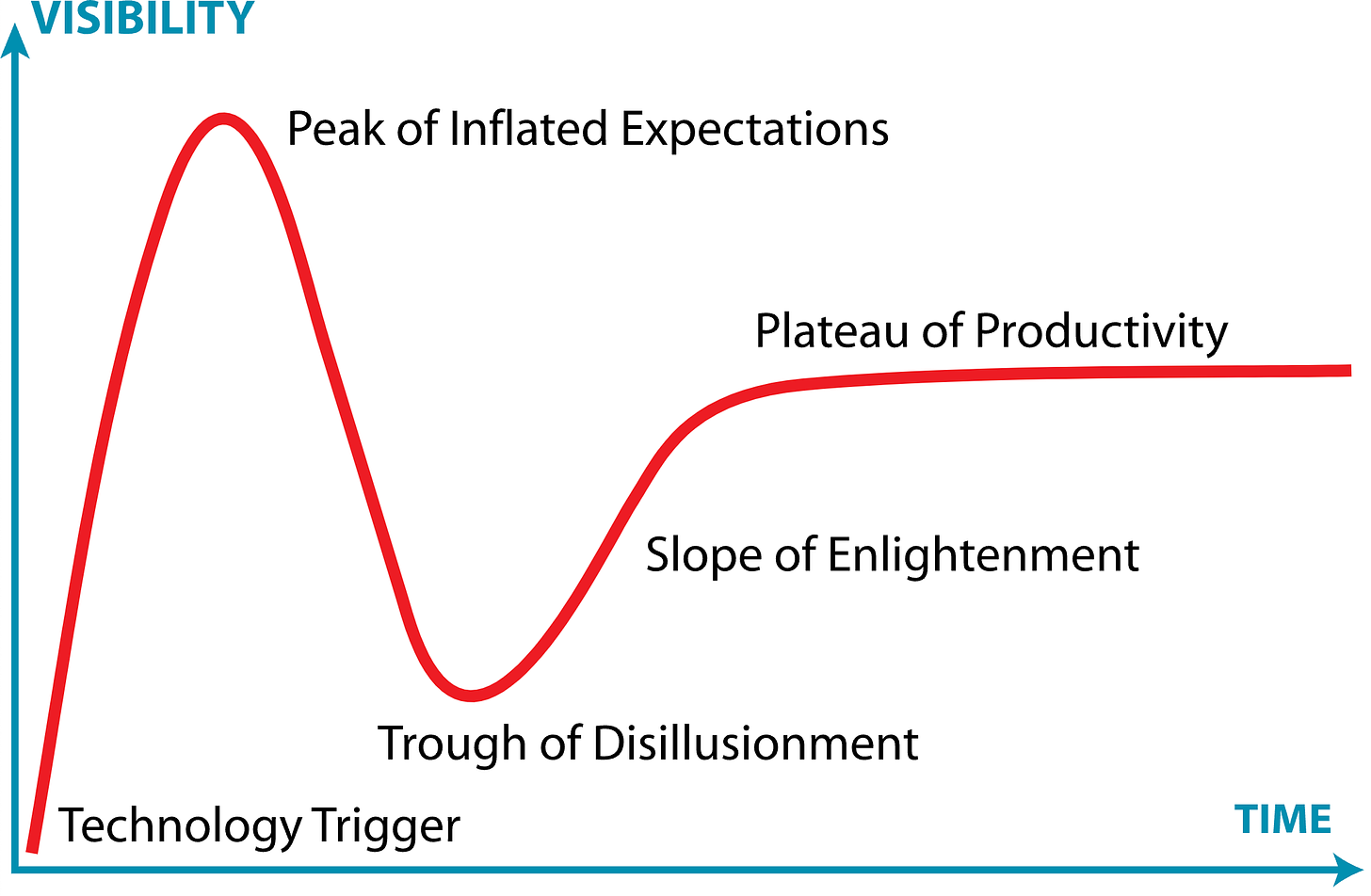

When it comes to AI, I believe that we are at the “Peak of Inflated Expectations” phase of the Gartner Hype Cycle. I expect a correction, during which most of the so-called “AI” companies will disappear, similar to the dotcom bust when a majority of “Internet companies” folded up shop. But similar to the post-dotcom-bust, the companies that survive the AI hype cycle will be the ones that provide true value, and those companies will grow massively. I see Nvidia as being one of those companies that survives - and I would compare its trajectory more to the cloud service providers of AWS and GCP, more than Cisco.

TLDR; I see long-term value and growth in Nvidia’s future, but I have a hard time justifying buying more shares at its current price. I plan to hold my current position and add to it once a correction happens. I’ll re-evaluate, and share my findings, after their earnings call on 8/28.

🚨

This is not investment advice.

DCF Assumptions (If you aren’t familiar with DCFs, I’d recommend skipping this section. I’m adding it for those people that want to know about underlying assumptions I made in the model.)

I used the perpetual growth rate model, and ran iterations from 2.0% to 3.5% to test various scenarios.

The discount rate was derived using the WACC approach.

I used 4% as the risk free rate and 8% as the market return rate.

I simplified cost of debt to be their interest expense payments as a percentage of their total debt.

I projected 5 years out from today.

I calculated a 10.6% discount rate using this approach. I tested various scenarios around this number, from 6.5% to 12.5%. Near the low end of the spectrum (7.0%), I finally saw upside in a neutral scenario. With a discount rate greater than that, only optimistic scenarios saw projected upside.